|

CONEXION LATINA TAX SERVICES

Offering services from our two locations in Lancaster, with a variety of services for the entire community. We are here for you twenty-four hours a day, seven days a week! Quickly and easily submit your application for a free automobile insurance quote using our easy-to-use website. As a customer, you will enjoy our suite of customer service forms all from your local agent. Income Tax Season from January to April 15 every year, call us today to get an appointment to file your taxes with us. |

File Today and be Done.

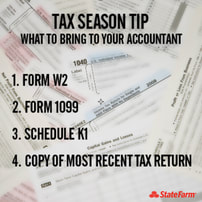

In a fast time, you could be finished with your taxes. Try us immediately, we are faster and easier than others tax companies, and we speak your lenguaje. Be Secure We employ experience people to do your taxes latest security to keep your confidential information safe. Maintaining your privacy is one of our top priorities. Complete and Accurate Need help? We're here for you every step of the way. All forms are available including business and rentals. Maximum Refund Guaranteed We are the only tax business in town that provide refund in 5minutes, with an excellent bank products and a reliable staf to get the best from your refund. Preparing your own taxes can be a difficult process, but leave it Conexion Latina Tax Services and you will have a great experience. We have a staff of experienced professionals to fulfill your needs, answer your questions and provide the best discounts on services, because we believe your money matters. |

Single Tax Declaration: $85.00

Married or Head of household: $99.00 Student: $55.00 or more Forms 1099 Nec-Misc (Easy) $125.00 Easy Business Declaration: $150.00 and more Complete Business: Starting from $250.00 and more Itin Number: $100.00 + (Tax declaration cost) Itin renewal: $100.00 Consultation: $25.00-$50.00 These prices are estimated, each case is different and may have a different cost for each individual need. Additional charges will be applied per amount of forms used and the time during the tax preparation. We don't do free estimates. Estimates need to be paid if you don't fill the taxes. |

GET YOUR ITIN NUMBER TODAY

What is an ITIN?

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service. It is a nine-digit number that always begins with the number 9 and has a range of 70-88 in the fourth and fifth digit. IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain a Social Security Number (SSN) from the Social Security Administration (SSA).

What is an ITIN used for?

ITINs are for federal tax reporting only, and are not intended to serve any other purpose. IRS issues ITINs to help individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security Numbers (SSNs).

An ITIN does not:

• Authorize work in the U.S.

• Provide eligibility for Social Security benefits

• Qualify a dependent for Earned Income Tax Credit Purposes

Who needs an ITIN?

IRS issues ITINs to foreign nationals and others who have federal tax reporting or filing requirements and do not qualify for SSNs. A non-resident alien individual not eligible for a SSN who is required to file a U.S. tax return only to claim a refund of tax under the provisions of a U.S. tax treaty needs an ITIN.

How do I know if I need an ITIN?

If you do not have a SSN and are not eligible to obtain a SSN, but you have a requirement to furnish a federal tax identification number or file a federal income tax return, you must apply for an ITIN.

How do I apply for an ITIN?

Call us today to apply, you must do your last Income Tax Declaration form to qualify for an ITIN .You have to attach a valid federal income tax return, unless you qualify for an exception, and include your original proof of identity or copies certified by issuing agency and foreign status documents.